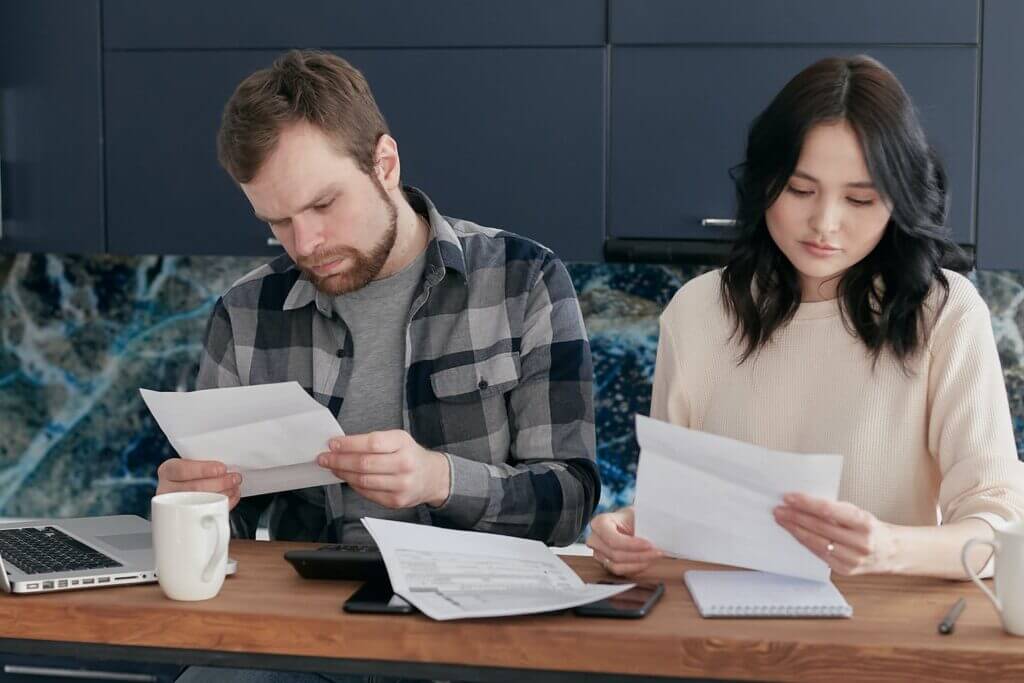

Dating can be awkward. Talking about finances can be awkward.

Put the two things together, and things can be super awkward if you let them.

A 2020 poll conducted by Personal Capital found that 53% of those who responded found that talking about money with their significant other was stressful, while 35% said they’d kept secrets about money to avoid conflict. (Note: Not all arguments are bad. You’re going to hit some tension. The important point is how you handle it.)

The important thing to remember is that finding common ground on finances is essential. You’ll need to figure out your own comfort level as you start dating, and be upfront about your dreams and expectations once things progress further.

Here are some things to keep in mind as you move forward.

Know the difference between casually dating and dating with a purpose.

Dating can be casual, but eventually, if you're with the right person, it should become purposeful: You’re looking for a potential mate and life partner.

If you’re dating, ask yourself why. The answer will help you decide how you approach the financial aspect of your relationship.

Of course, you’re not (necessarily) going to marry the first person you date. It’s important to be thoughtful and selective, and you should take the same approach with your finances. On first dates, that’s basically limited to who should pay for the meal, movie tickets, or whatever.

You and your date may have different ideas about this. Some might think that whoever does the inviting should pick up the check.

But a survey of 300,000 people found that most people are traditionalists: Nearly 63% of men and 46% of women think the man should pay; just 5% or less of both groups said the woman should, while 18% of women and 7% of men preferred to split the bill. The rest simply said they “don’t mind” paying.

That single decision is relatively simple compared with what you’ll encounter as dating evolves into a more serious relationship. Then you’ll want to share more of your philosophy about money and what’s behind it.

It’s important, in a serious relationship, to know what (and whom) you’re dealing with, because more than 70% of married couples fight about money more than anything else.

Set a budget for each date… and stick to it.

It’s fun to be spontaneous, but it’s a good idea to be purposeful when it comes to opening your wallet or your purse.

If you have an overall budget for the evening, it can guide your decisions. If you’re eating dinner out, you may want to choose between an appetizer or a dessert. Do you want to hit an evening movie after dinner, or would you prefer a matinee beforehand to take advantage of less-expensive tickets?

Once you figure out what your budget is, stick to it. If it becomes a source of tension or resentment early in the dating process, that could be a red flag. Furthermore, it could create much deeper resentment later on if it’s not addressed. Whatever you do, don’t ignore it.

And don’t be afraid of things not working out. It’s not a matter of either one of you not being good enough, and it’s not about rejection. Sometimes, two people just have different interests and priorities. That goes for financial goals and approaches, too. And that’s perfectly OK.

Don’t lose sight of your long-term goals.

One way to approach conversations about money as things get more serious is by approaching it from the opposite direction: Instead of talking about how much you’re willing to spend on this or that, identify long-term goals and talk openly about what it will take to get there.

Chances are, if you’ve reached a deeper point in your relationship, you’ve found a lot in common. As you talk about these things, you’ll come to an agreement about where you want to go, which will make deciding how to get there less problematic.

That’s not to say it will be easy, but at least you’ll agree on the objective. If you continue with the relationship, that will make agreeing on financial priorities a natural next step.

As financial coach Dan Hinz told Forbes, “Your first step is to define a common goal that you both want. ... Anything that helps you combine forces rather than fighting each other. Budgeting together is great. But common goals are—by far—the best."

Don’t be afraid to talk about money.

Don’t be afraid to discuss finances, but do be intentional about how you do it. As your relationship progresses, reaching agreements will become more important. It won’t be simply about deciding whether to go for a walk on the beach or to meet at that little café around the corner. It will be about things like career choices, where you’d like to live, and dreams for a family.

The important thing is to strike a balance. Don’t assume the other person is at the same place you are. Ask. Find out.

It’s less threatening to pose questions in the abstract and to empower the other person to respond openly without pressuring each other. You both have individual goals. Find out how, and whether, they fit together.

Further along, if you’re considering something permanent, you’ll want to talk about finances more concretely: Saving for the future, building credit for better security, paying down debt—and what you’d need to do to achieve those things.

Each stage in a relationship is different, and that’s true when it comes to money, as well. If you proceed with understanding and authenticity guided by your faith, you’ll have a good foundation for dealing with even sensitive subjects like finances.